Press Release

|January 15,2026Developers' Sales Fell To The Lowest In Nearly Two Years In December 2025, As A Lack Of Major Launches And The Seasonal Lull Curtailed Market Activity

Share this article:

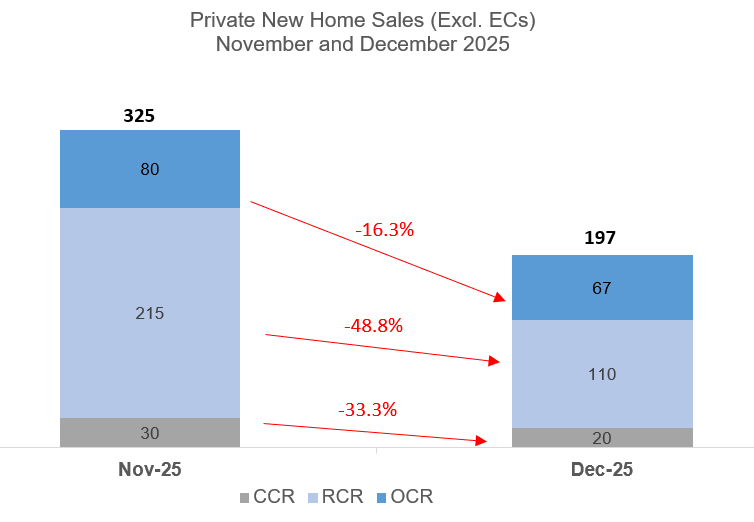

15 January 2026, Singapore - Limited project launches and year-end seasonal lull have pulled developers' sales to a near two-year low in December, with 197 new homes (ex. Executive Condominiums) sold during the month. This is the lowest monthly new private home sales since 153 units were transacted in February 2024. In December, developers' sales were down by 39% month-on-month from the 325 units sold in November, while sales declined by 3% year-on-year from the 203 units shifted in December 2024.

There was just one new project put on the market in December, being the 186-unit landed housing development, Pollen Collection II in District 28 in the Outside Central Region (OCR). In December, developers launched 52 new units for sale (all at Pollen Collection II) marking an 85% decline from the 347 units launched in the previous month.

Taking in December's sales tally, developers have sold an estimated 10,821 new homes (ex. EC) in 2025 - about 67% higher than the 6,469 units transacted in 2024 and it is the highest annual new home sales in four years.

The sales in December were mainly driven by the Rest of Central Region (RCR) where 110 new units were sold. The top-selling RCR project during the month was The Continuum which sold 31 units at a median price of $2,498 psf (see Table 1). Of the 31 units sold, 22 of them are smaller homes spanning about 560 sq ft, according to caveats lodged. The freehold development in Thiam Siew Avenue has sold 672 out of its 816 (82%) units since it was launched in May 2023. Another project that supported RCR sales was Nava Grove which moved 15 units at a median price of $2,641 psf. The 552-unit Nava Grove is 94% sold as at the end of December.

Meanwhile, developers sold 67 new homes (ex. EC) in the OCR, with newly launched project, Pollen Collection II topping sales in this sub-market. The landed home development in the Serangoon area sold 17 terrace houses at a median price of $2,599 psf in December. New home sales in the OCR are expected to pick up in January, with the upcoming launch of 540-unit Narra Residences in Dairy Farm.

Over in the Core Central Region (CCR), developers' sales fell to 20 units in December from 30 units in the previous month. The project that posted the highest sales in the month was UpperHouse at Orchard Boulevard which sold seven units at a median price of $3,410 psf. The priciest new private home sold in December was a 4,489-sq ft unit at 21 Anderson which fetched $23.3 million. In January, the 246-unit Newport Residences in Anson Road in the central business district is slated to be put on the market; the freehold mixed-use development could likely help to push up transactions in the CCR.

In the EC segment, there were 37 new units sold in December, up by 76% from the 21 units shifted in November. The most popular EC project during the month was Otto Place EC which moved 28 units at a median price of $1,751 psf. Similarly, with the launch of the 748-unit Coastal Cabana EC in Pasir Ris set for January, EC sales will see a big boost given the typically strong demand for such housing type among first-time homebuyers and HDB upgraders. As at the end of December, there were just 17 unsold new EC units on the market, as per URA data.

Ms Wong Siew Ying, Head of Research and Content, PropNex said:

"Developers' sales ended the year on a decidedly quieter note, with 197 new units (ex. EC) sold - the lowest monthly tally since February 2024. The muted sales largely reflect a lack of major new project launches in the month, and we expect transactions to likely pick up substantially in January, with two projects - Narra Residences (OCR) and Newport Residences (CCR) - slated to be launched. Based on the price guidance from developers, we anticipate buyers could respond positively to Narra Residences and Newport Residences, with prices starting from $998,000 and $1.298 million for one-bedroom units, respectively. In particular, Newport Residences looks to be a rare opportunity as there are not many new freehold condo launches in the city centre (referring to Districts 1 and 2), the last one being Sky Everton in 2019.

In addition, the sales booking of units at Coastal Cabana EC later this week (17 January 2026) will also add more buzz to the residential property market, following the year-end seasonal lull. Coastal Cabana will likely see some pent-up demand as it is the first EC launch in Pasir Ris since Sea Horizon hit the market in 2013. Prices of three-bedroom units at Coastal Cabana EC start from $1.438 million, and four-bedders from $1.623 million.

Taking in December's sales, developers sold a combined 10,821 new homes (ex. EC) in 2025, the highest annual sales in four years. It is also markedly higher than the 10-year average annual developers' sales of 8,768 units (ex. EC) from 2015 to 2024. The surge in sales was mainly due to easing interest rates, improved buyer sentiment, and the injection of more new launches to the market. Further, the strong sales in 2025 suggest that pricing was compelling enough to attract buyers - about 66% of the new non-landed private homes (ex. EC) sold in 2025 were priced at below $2.5 million, according to caveats lodged.

Based on updated estimates (as at 6 January 2026) from our sales team, about 9,700 units of private homes (ex. EC) from 24 projects and five EC projects with some 2,300 new EC units are potentially in the launch pipeline in 2026 - offering ample choices to prospective homebuyers this year. About 26% of the 9,700 units (ex. EC) are in the CCR, 17% in the RCR and 57% in the OCR. The higher proportion of OCR launches, plus several new EC projects on tap will provide more affordable private housing choices to mass-market homebuyers, and this will help to support market sustainability. We think they will also offer HDB flat owners a clear upgrade path, for those looking at buying a new private home as part of their asset progression journey.

In December, Singaporean buyers continued to lead the way, accounting for 84.6% of the new non-landed private homes (ex. EC) sold, while Singapore PRs and foreigners (non-PR) made up 13.7% and about 1.6% of the sales, respectively. There were just three transactions - namely at 21 Anderson, Pinetree Hill, and The Continuum - by foreign buyers (NPR) in December compared with 10 in November. All in, 153 new non-landed private home transactions were by foreigners (NPR) in 2025, accounting for 1.4% of the total -on par with the corresponding proportion in 2024.

Looking ahead, we expect private home sales to remain driven by Singaporeans, and developers will likely keep launch prices competitive, in view of price sensitivity and affordability concerns among local buyers. The relatively stable interest rate expectations in 2026 may also lead to a steadier property market, one that is less fueled by rate-cut optimism and hype. For 2026, we expect that developers' sales could range from 8,000 to 9,000 units (ex. EC), possibly coming in at the higher end of our forecast range."

Table 1: Top-Selling Private Residential Projects (ex. EC) in December 2025

S/N | Project | Region | Units sold in Dec 2025 | Median price in Dec 2025 ($PSF) |

1 | THE CONTINUUM | RCR | 31 | $2,498 |

2 | POLLEN COLLECTION II | OCR | 17 | $2,599 |

3 | NAVA GROVE | RCR | 15 | $2,641 |

4 | CANBERRA CRESCENT RESIDENCES | OCR | 8 | $2,008 |

| PINETREE HILL | RCR | 8 | $2,593 |

5 | UPPERHOUSE AT ORCHARD BOULEVARD | CCR | 7 | $3,410 |

6 | BLOOMSBURY RESIDENCES | RCR | 6 | $2,542 |

| ONE MARINA GARDENS | RCR | 6 | $3,066 |

7 | THE SEN | RCR | 5 | $2,341 |

| CHUAN PARK | OCR | 5 | $2,754 |

| THE ORIE | RCR | 5 | $2,727 |

| 8@BT | RCR | 5 | $2,624 |

| LENTORIA | OCR | 5 | $2,439 |